What You Should Know About Your Commercial Storm Coverage

12/23/2019 (Permalink)

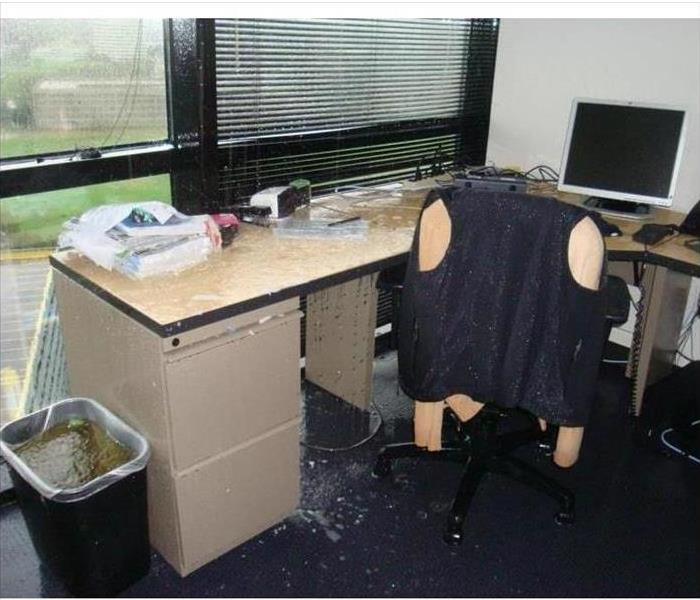

Standard commercial property insurance policies cover damage from fire, explosion, burst pipes, storms, theft and vandalism, however, many commercial property policies specifically exclude some types of storm damage. Coverages vary by location and policy. A good place to begin the process of ensuring your business has all of the storm insurance coverage you need is to review your policy with an insurance professional in New Sweden,TX. Some topics you may wish to discuss include:

Types of Property Covered

Expensive or specialized business equipment may need to be scheduled separately to be covered by your policy. Typical commercial property policies cover the following types of property:

- Buildings

- Computers

- Furniture and equipment

- Exterior signs

- Fences and landscaping

- Important documents

- Inventory

- Property belonging to other people that is damaged while in your possession

Hurricanes and Windstorms

Damage from a tornado, straight-line winds or thunderstorm is covered by most standard commercial property insurance policies, however many policies exclude storm damage and storm cleanup costs caused by hurricanes and tropical storms. If your business is in a coastal area, you may want to consider adding a storm insurance policy or rider that specifically covers hurricane and windstorm damage. Some coastal areas have residual markets, called Beach Plans, that exist specifically to provide coverage for property in areas at high risk for hurricane damage that the standard market may decline to cover.

Business Interruption Insurance

Business interruption insurance coverage helps cover the cost of expenses that are ongoing while your business can not operate due to damage from a covered peril. Much like with your property coverage, you may need a separate rider to cover you for business interruptions that result from hurricane damage.

Reviewing your storm insurance policy can help you avoid any surprises in the event your business suffers a loss. It can also help you identify any unique risks you may have and work with your insurance professional to ensure your coverage best meets the needs of your business.

24/7 Emergency Service

24/7 Emergency Service